iPhone Insurance with No Deductible: Is It Possible?

Related Articles

- IPhone Insurance Vs. AppleCare: Which Is Better?

- Why You Need IPhone Insurance For Your New Device: A Comprehensive Guide

- IPhone Insurance Vs. AppleCare: Which Is Better?

- IPhone Insurance For Theft And Loss: A Comprehensive Guide

- The Cost Of IPhone Insurance: Is It Worth It?

Introduction

If iPhone Insurance with No Deductible: Is It Possible? has caught your interest, stay with us as we break down everything you need to know.

Video about

iPhone Insurance with No Deductible: Is It Possible?

Smartphones have become an indispensable part of our lives, and the iPhone is one of the most popular choices. With its sleek design, powerful features, and extensive app ecosystem, it’s no wonder that so many people rely on their iPhones for everything from staying connected to managing their finances.

However, iPhones are also expensive devices, and accidents happen. If your iPhone is damaged or stolen, you could be facing a hefty repair or replacement bill. That’s where iPhone insurance comes in.

What Is iPhone Insurance?

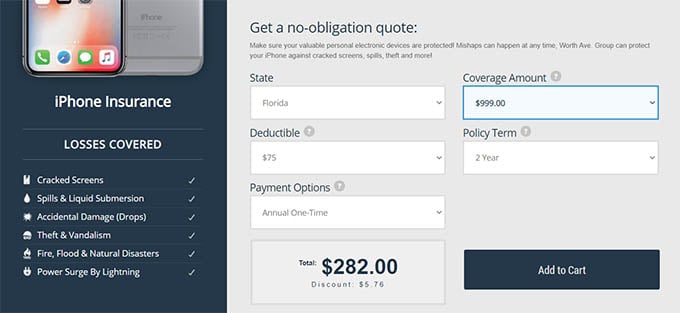

iPhone insurance is a type of insurance policy that covers the cost of repairing or replacing your iPhone if it is damaged, lost, or stolen. There are many different types of iPhone insurance policies available, with varying levels of coverage and deductibles.

What Is a Deductible?

A deductible is the amount of money that you have to pay out of pocket before your insurance coverage kicks in. For example, if you have a $100 deductible on your iPhone insurance policy, you would have to pay the first $100 of any repair or replacement costs.

iPhone Insurance with No Deductible

iPhone insurance with no deductible is exactly what it sounds like: an insurance policy that covers the cost of repairing or replacing your iPhone without requiring you to pay a deductible. This type of insurance is typically more expensive than policies with a deductible, but it can provide peace of mind knowing that you won’t have to pay anything out of pocket if your iPhone is damaged or stolen.

Is iPhone Insurance with No Deductible Worth It?

Whether or not iPhone insurance with no deductible is worth it depends on your individual circumstances. If you are prone to accidents or if you live in an area with a high crime rate, then it may be worth it to invest in a policy with no deductible. However, if you are careful with your iPhone and you live in a safe area, then you may be able to get by with a policy with a lower deductible.

How to Find the Best iPhone Insurance Policy

There are many different iPhone insurance policies available, so it’s important to shop around and compare prices before you buy. Here are a few things to keep in mind when shopping for iPhone insurance:

- Coverage: Make sure that the policy covers the types of damage or loss that you are most concerned about.

- Deductible: Choose a deductible that you are comfortable with.

- Price: Compare prices from different insurance companies before you buy.

- Reviews: Read reviews of different insurance companies to see what other customers have to say about their experience.

Conclusion

iPhone insurance can provide peace of mind knowing that you are covered if your iPhone is damaged or stolen. However, it’s important to weigh the cost of insurance against the risk of damage or loss. If you are careful with your iPhone and you live in a safe area, then you may be able to get by without insurance. However, if you are prone to accidents or if you live in an area with a high crime rate, then it may be worth it to invest in an iPhone insurance policy.

Source

Closure

Don’t miss out on future updates about iPhone Insurance with No Deductible: Is It Possible?—we’ve got more exciting content coming your way.