iPhone Insurance with No Deductible: Is It Possible?

Related Articles

- IPhone Insurance For Businesses: A Comprehensive Guide

- Top 5 IPhone Insurance Providers In The USA: A Comprehensive Guide

- IPhone Insurance: A Comprehensive Guide To Coverage And Importance

- How To Choose The Best IPhone Insurance Plan: A Comprehensive Guide

- Top 5 IPhone Insurance Providers In The USA: An In-Depth Exploration

Introduction

Looking for the latest scoop on iPhone Insurance with No Deductible: Is It Possible?? We’ve compiled the most useful information for you.

Video about

iPhone Insurance with No Deductible: Is It Possible?

Smartphones have become an indispensable part of our lives, and the iPhone is one of the most popular choices. With its high price tag, it’s important to protect your investment with insurance. However, traditional insurance plans often come with a deductible, which means you have to pay a certain amount out of pocket before your coverage kicks in. This can be a significant expense, especially if you need to make a claim for a major repair or replacement.

So, is it possible to get iPhone insurance with no deductible? The answer is yes, but it’s not always easy to find.

How to Find iPhone Insurance with No Deductible

There are a few different ways to find iPhone insurance with no deductible. One option is to go through your carrier. Some carriers, such as Verizon and AT&T, offer insurance plans that include no deductible. However, these plans are often more expensive than plans with a deductible.

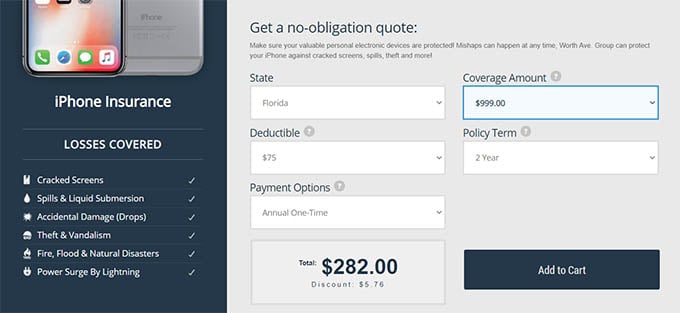

Another option is to purchase insurance from a third-party provider. There are a number of companies that offer iPhone insurance, and some of them offer plans with no deductible. However, it’s important to compare the coverage and costs of these plans carefully before making a decision.

What to Look for in an iPhone Insurance Plan

When you’re shopping for iPhone insurance, there are a few things you should keep in mind:

- Coverage: Make sure the plan covers the types of damage you’re most likely to encounter, such as accidental damage, theft, and loss.

- Deductible: If you can find a plan with no deductible, that’s ideal. However, if you’re on a budget, you may be willing to accept a plan with a low deductible.

- Cost: The cost of insurance will vary depending on the coverage and deductible you choose. Be sure to compare the costs of different plans before making a decision.

Benefits of iPhone Insurance with No Deductible

There are several benefits to having iPhone insurance with no deductible:

- Peace of mind: Knowing that you’re covered for any type of damage can give you peace of mind.

- No out-of-pocket costs: If you need to make a claim, you won’t have to pay a deductible. This can save you a significant amount of money.

- Fast and easy claims process: Most insurance companies offer a fast and easy claims process. This means you can get your phone repaired or replaced quickly and easily.

FAQs

Q: Is it worth it to get iPhone insurance?

A: Whether or not iPhone insurance is worth it depends on your individual circumstances. If you’re prone to accidents or if you’re worried about your phone being stolen or lost, then insurance is a good idea.

Q: How much does iPhone insurance cost?

A: The cost of iPhone insurance will vary depending on the coverage and deductible you choose. However, you can expect to pay around $10-$20 per month for a basic plan.

Q: What is the claims process for iPhone insurance?

A: The claims process for iPhone insurance is typically very simple. You can usually file a claim online or over the phone. Once you’ve filed a claim, the insurance company will send you a prepaid shipping label. You can then send your phone to the insurance company for repair or replacement.

Conclusion

iPhone insurance with no deductible can be a valuable investment. It can give you peace of mind and protect you from unexpected expenses. However, it’s important to compare the coverage and costs of different plans before making a decision.

Sources

Closure

Don’t miss out on future updates about iPhone Insurance with No Deductible: Is It Possible?—we’ve got more exciting content coming your way.